The role of energy exchanges

The fundamental activity of an energy exchange, similar to securities and other exchanges, is to bring together demand and supply. In the wholesale energy market, bids (to buy energy) and offers (to sell energy) are pooled in the trading system and based on the bids and offers the energy exchange determines a purchase price, also known as the market clearing price. In liberalised energy markets where generation and retail activities are unbundled from the (natural) monopoly activities of transmission and distribution, buying and selling of energy is done in a competitive market environment. Exchange trading is one way of entering a transaction for the sale / purchase of energy. When trading physical energy or energy derivatives, market participants typically have the choice of trading bilaterally, over-the-counter (OTC) or on an exchange.

Trading on an exchange allows liquidity to be pooled which means that market participants who wish to buy or sell energy can anonymously, and on an equal basis, show their willingness to pay or sell standardised quantities at a certain price level. Matching these so called bids and offers helps to determine a fair and transparent market price which is available to all trading participants and the wider public – the more bids and offers, the more reliable the price. Reliable and widely available prices are essential to steering production and consumption, making demand side flexibility available and to decide on future energy investments.

Clearing is an important and value-adding feature that is typically offered when trading on an exchange as trading occurs on an anonymous basis and trading parties are not able to judge the creditworthiness of their counterparts. Clearing is the process of mitigating the counterparty default risk by financially guaranteeing the fulfilment of the concluded transactions. Derivatives traded on an exchange (e.g. a regulated market) are required to be cleared by a Central Counterparty (CCP) Clearing House. Energy exchanges often also act as the interface for clearing pre-arranged (OTC) trades.

energy spot markets

Energy spot markets are used to buy and sell physical quantities of power and gas in a short-term timeframe ahead of delivery. Particularly in electricity markets, it is necessary to constantly balance the supply (generation) and demand (consumption). A day ahead auction takes place once a day, where buy and sell orders for all hours of the following day are anonymously matched, resulting in a market clearing price for each hour of that following day and an obligation for the buyer or seller to take or make delivery. The intraday market is used by market participants to balance their positions closer to real-time, with buy and sell orders matched continuously for delivery the same day.

Balancing and ancillary services markets allow the Transmission System Operators (TSOs) to procure reserve power and maintain system stability and frequency close to real time.

European electricity market coupling allows cross-border trading, simultaneously taking into account cross-border transmission constraints on the interconnectors as well as the energy traded, by use of an optimisation algorithm. This ultimately enables more efficient use of generation and transmission assets across Europe. More information on Single Day Ahead Coupling (SDAC) and Single Intraday Coupling (SIDC) can be found on the All NEMO Committee website.

Futures (derivatives) markets

Futures and forwards contracts are used by energy market participants to buy or sell a specific volume of gas or electricity, at a specific price, for settlement on a specific date in the future. Many of these contracts, do not result in physical delivery of the commodity (and are therefore called cash-settled), but are used by market participants, including energy generators, consumers, retailers etc., to hedge against price risks they might have related to the energy market. A “future” usually refers to a standardised contract traded on an exchange, while, “forward” is generally used to describe a contract that is entered into between two parties who have agreed a set of terms between themselves, that can be more tailored to hedge specific risks. This hedging mechanism is critical for both large, industrial energy consumers, as well as for smaller, independent retailers.

A derivative is financial security with a value that is reliant upon or derived from, an underlying asset, in this case electricity or gas. Most electricity and gas derivative contracts, as well as EU ETS emission allowances, are classed as financial instruments, and are therefore subject to a range of financial services regulation, which introduce a wide range of organisational, conduct and market infrastructure obligations designed to increase transparency and help ensure safe and orderly trading. This includes, among others, the:

- Markets in Financial Instruments Directive (MiFID II) and Regulation (MiFIR);

- The European Market Infrastructure Regulation (EMIR);

- Market Abuse Regulation (MAR);

- Benchmarks Regulation (BMR).

These provisions are designed to cover a wide range of asset classes, as compared for example to REMIT, which is specifically designed for energy markets. Therefore, one challenge is to make sure that the specific characteristics of energy markets are taken into account when designing and/or amending financial services regulation.

Delegated Operators

In a number of EU/EEA Member States and Energy Community Contracting Parties, key functions related to the electricity balancing market are carried out by non-TSO entities. The tasks of these third parties, defined for the first time in the Electricity Regulation (EU) 2019/943 as ‘delegated operators’, include, among others, facilitation of balancing markets, imbalance calculation and settlement, data publication related to electricity balancing markets and issuing of the rules related to balancing markets. These tasks underpin the electricity market and represent the link between the physical exchange of electricity among market participants and the financial outcomes.

A guide to the Balancing and Settlement Code (BSC) has been produced by Elexon, providing further detail on balancing and settlement arrangements in Great Britain.

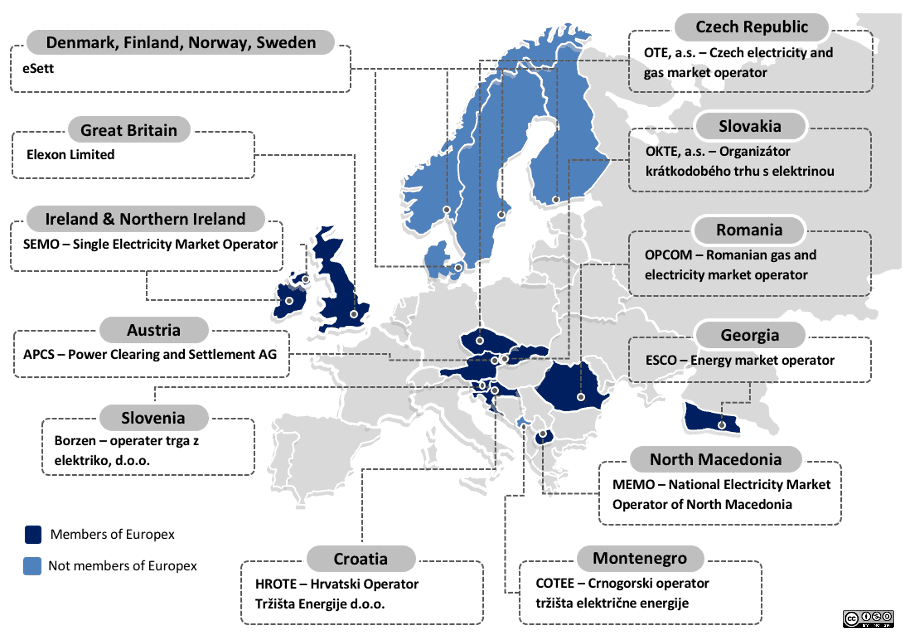

Delegated operator arrangements are already established in twelve EU Member States and two Energy Community Contracting Parties. Europex members who are Delegated Operators include APCS (Austria), Borzen (Slovenia), Elexon (Great Britain), ESCO (Georgia), HROTE (Croatia), MEMO (North Macedonia), OKTE (Slovakia), OPCOM (Romania), OTE (Czech Republic) and SEMO (Island of Ireland).

REMIT

The EU Regulation on wholesale energy market integrity and transparency (REMIT) introduces a specific framework for monitoring wholesale electricity and gas markets and is designed to prevent market abuse such as insider trading and market manipulation. Market participants are obliged to register with their national regulatory authority (NRA) and provide information to ACER for market monitoring purposes.

Electricity and gas exchanges have the status of OMPs, as defined in the REMIT Implementing Regulation, and most act as Registered Reporting Mechanisms (RRMs). As market places, OMPs are obliged to provide a data reporting solution to their clients, while RRMs report relevant transactions to ACER on behalf of market participants. In either role, an important aim is to facilitate data reporting for market participants under REMIT, and ultimately contribute to increased market integrity and transparency.

Some Europex members also operate Inside Information Platforms (IIPs) pursuant to Article 4 of REMIT. IIPs are ACER-certified electronic publication platforms that allow for the disclosure of Urgent Market Messages (UMMs) and other relevant information which could qualify as inside information. This can refer to planned and unplanned outages of power plants, the availability of transmission and transportation capacity, etc.